are diabetic socks tax deductible for irs

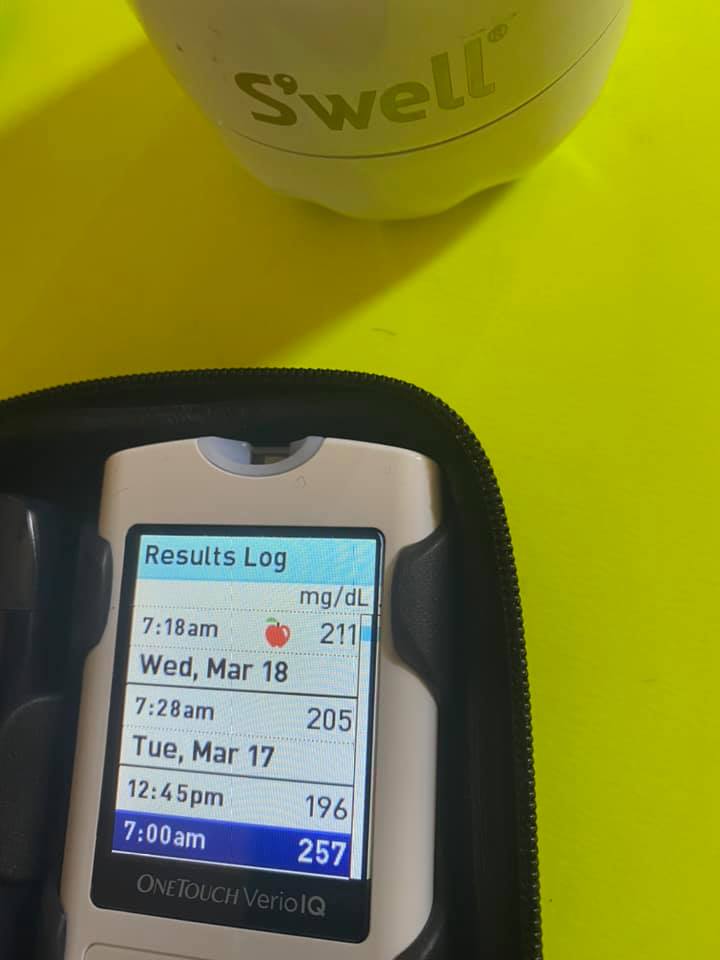

Can I write off diabetic supplies?

There are a wide range of expenses that you can include in your medical deduction including the purchase price of blood sugar monitoring kits, test strips, insulin and other medications prescribed by your doctor to treat your diabetes.

Thousands of people suffering from erratic blood sugar has been using this ground-breaking solution…

To help them burn away dangerous fat from their vital organs and bellies…

While stabilizing their blood sugar levels naturally and effectively.

And starting today…

Can you claim compression stockings on your taxes?

You bet! As long as the compression socks are medically necessary, then they’re an eligible medical expense and can be claimed through your HSA. Even better is that there isn’t a limit as to how many pairs of compression socks you can claim per year, you just need the funds available for reimbursement.

Can you deduct out of pocket medical expenses?

If the medical bills you pay out of pocket in a year exceed 7.5 percent of your adjusted gross income (AGI), you may deduct only the amount of your medical expenses that exceed 7.5 percent of your AGI from your taxes. You also must itemize your deductions to deduct your medical expenses.

Can Type 1 diabetics claim disability?

The short answer is “Yes.” Under most laws, diabetes is a protected as a disability. Both type 1 and type 2 diabetes are protected as disabilities.

Are eyeglasses tax deductible in 2020?

Who Can Take the Eyeglasses Deduction in 2020? You may be able to claim the cost of your eyeglasses as a deducible expense if you itemize your deductions for 2020 on Schedule A. That means that you’re using Form 1040 or 1040-SR. The deduction also counts for your spouse or dependents.

Can I write off my hot tub as a medical expense?

If you have a medical condition that can be improved or treated by a time spent soaking in a hot tub, you may be able to deduct the purchase and installation expense on your tax return. A medical tax deduction expense will usually reduce your cost of owning the hot tub by 25%-40%.

Are incontinence supplies tax deductible?

According to the guideline, incontinence supplies can be tax deductible if you can show they are needed for a specific disease. In most cases, the cost of incontinence supplies can be covered through an insurance plan, a government program, a flexible spending account or a health savings account.

What medical expenses are deductible for 2020?

You can only claim expenses that you paid during the tax year, and you can only deduct medical expenses that exceed 7.5% of your adjusted gross income (AGI) in 2020. So if your AGI is $50,000, then you can claim the deduction for the amount of medical expenses that exceed $3,750.

Can you claim dental on taxes?

Most, non-cosmetic, dental expenses are tax deductible. If you paid for dental work, you may be able to claim them as eligible medical expenses on your income tax and benefit return (T1), including: Dental care. Dentures and Implants.

What can I claim on tax without receipts 2021?

How much can I claim with no receipts? The ATO generally says that if you have no receipts at all, but you did buy work-related items, then you can claim them up to a maximum value of $300 (in total, not per item). Chances are, you are eligible to claim more than $300. This could boost your tax refund considerably.

What else can I deduct if I take the standard deduction?

If you take the standard deduction on your 2020 tax return, you can deduct up to $300 for cash donations to charity you made during the year. For instance, joint filers can claim up to $600 for cash donations on their 2021 return. The 2021 deduction won’t reduce your AGI, either.

Can you claim deductions without receipts?

You can still claim deductions on your taxes without receipts for every transaction. If you don’t have original receipts, other acceptable records may include canceled checks, credit or debit card statements, written records you create, calendar notations, and photographs.

What is life expectancy of Type 1 diabetic?

The investigators found that men with type 1 diabetes had an average life expectancy of about 66 years, compared with 77 years among men without it. Women with type 1 diabetes had an average life expectancy of about 68 years, compared with 81 years for those without the disease, the study found.

Does diabetes qualify for SSI?

Diabetes is listed in the Social Security Administration’s (SSA) impairment listing manual, or “Blue Book,” as a condition which can qualify a person for Social Security Disability benefits.

Can you write off sunglasses?

The cost of eye exams, contact lenses, contact lens insurance, and prescription glasses (including sunglasses) is deductible, assuming your insurance doesn’t have a vision plan. So is eye surgery such as LASIK to correct vision problems. Braille books are also deductible.

Are dental expenses tax deductible 2021?

-Medical expenses: When filing Form 1040, you can deduct the amount of medical and dental expenses that are more than 7.5% of your AGI. The only condition is that the expenses were paid in 2021.

Are OTC drugs deductible in 2020?

Effective Jan. 1, 2020, the CARES Act treats all OTC drugs and menstrual care products as qualifying medical expenses that may be paid for (or reimbursed) on a tax-free basis by an HSA, health FSA, HRA or Archer MSA.

Can a doctor write a prescription for a hot tub?

There are many medical conditions for which a hot tub purchase may qualify for a medical deduction including injuries suffered in an automobile accident. A doctor’s prescription can turn your hot tub into a piece of deductible medical equipment, as long as you satisfy a few IRS conditions.

Are swim spas tax deductible?

Yes, you can deduct the cost of the swim spa and installation if it was prescribed, as you stated, and it is for the treatment of a disease.

Is buying a hot tub a good idea?

When you use your hot tub regularly and thoroughly enjoy its intended benefits, it’s worth the investment. When you choose the right hot tub, you won’t regret the investment. In fact, you’ll most likely discover the benefits you never even expected.

My successful Diabetes Treatment Story

My doctor diagnosed me with diabetes just over a year ago, at the time I was prescribed Metformin. I went to the some diabetes related websites and learned about the diet they suggested. I started the diet right away and I was very loyal to it. However, after weeks of being on the diet it never helped, my blood sugar didn’t drop like I wanted it to. My personal physician wasn’t much help either, he didn’t really seem to give me any other options besides my prescription and the usual course of insulin. I was about to give up and then I discovered a great treatment method. The guide was authored by one of the leading professionals in the world of diabetes research, Dr. Max Sidorov. This is a guide that that shows you, in a very simple way, how to conquer the disease without traditional methods. I have to say that since I’ve found the guide and followed it, I’ve not only improved my health but I’ve also lost weight and improved other aspects as well. My activities have increased and I have a ton of energy! It is my goal to share the this diabetes treatment method as much as possible to show people there’s more to the disease than traditional schools of thought and you can find your own path to healing with natural methods.Thousands of people suffering from erratic blood sugar has been using this ground-breaking solution…

To help them burn away dangerous fat from their vital organs and bellies…

While stabilizing their blood sugar levels naturally and effectively.

And starting today…